How to Face Uncertain Economic Conditions as a business?

As a business, facing uncertain economic outlook can be a challenging situation. However, there are certain steps that can be taken to prepare for these uncertainties.

Firstly, it is important to conduct an analysis of your business model, including your revenue streams and cost structure. This will help identify any areas of weakness that need to be addressed before any economic downturn.

Secondly, reducing unnecessary expenses and finding ways to be more efficient can help prepare for potential financial challenges.

Thirdly, diversifying your customer base and expanding into new markets can help protect your business from economic shocks in specific industries or regions.

Fourthly, it is also important to maintain solid relationships with suppliers, customers, and stakeholders.

Lastly, creating a contingency plan that includes scenarios of economic decline and pre-determined actions to mitigate risks can help prepare your business for any unexpected circumstances. By being proactive and taking these necessary steps, your business can improve its chances of success during uncertain economic times.

How to Keep Employee Morale During Layoffs?

To maintain employee morale during layoffs, employers should communicate openly and transparently, offer support, recognize and appreciate surviving employees, and celebrate successes and milestones.

How to Tackle Supply Chain Disruptions?

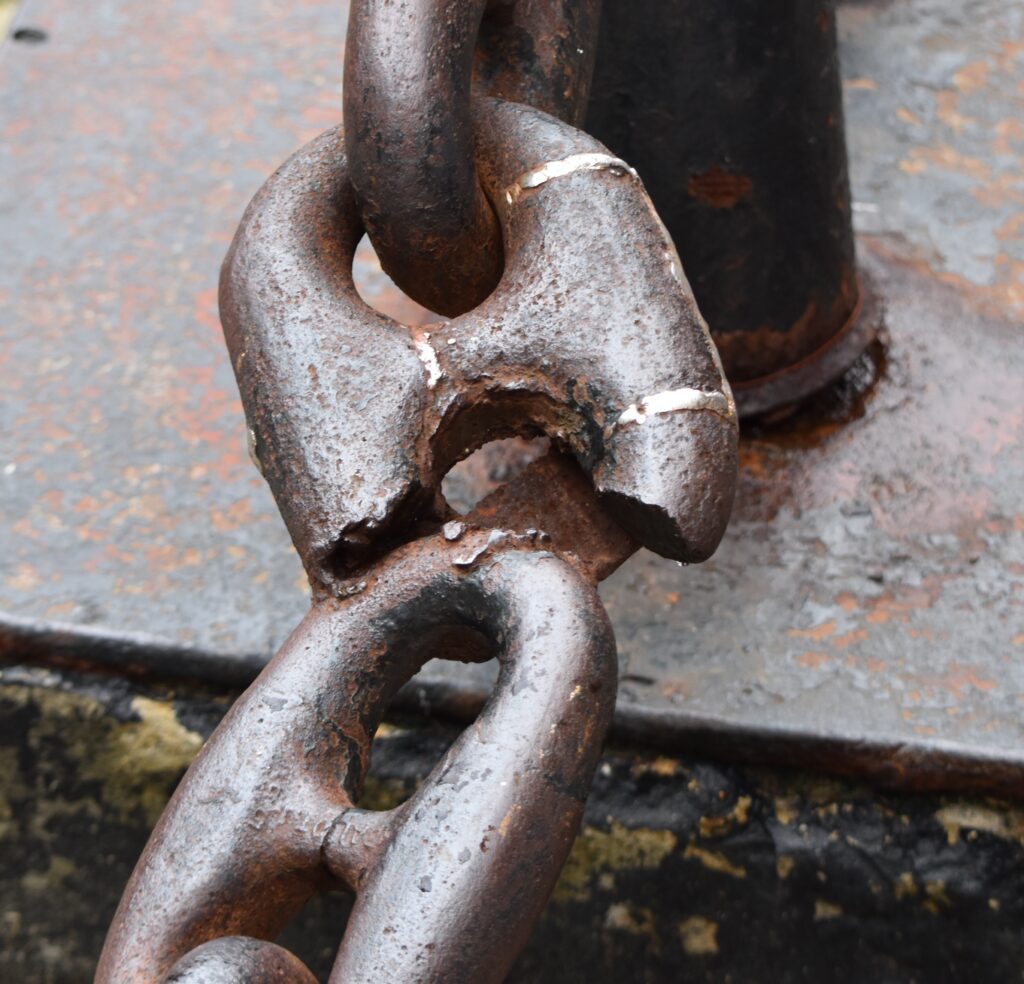

Supply chain disruptions, caused by factors such as natural disasters, pandemics, economic downturns, and geopolitical conflicts, can have costly consequences for businesses, including financial losses and reputational damage. To mitigate the risks, businesses can take proactive measures such as diversifying supplier networks, having contingency plans, leveraging technology for monitoring performance, optimizing inventory, developing collaborative relationships, implementing risk management strategies, and investing in digital transformation. Additionally, enhancing visibility and transparency, adopting agile structures, and conducting regular assessments can help build resilience and minimize supply chain disruptions’ impacts. By adopting these strategies, businesses can effectively manage risks and maintain continuity in the face of unforeseen disruptions.

How to Secure Credits During Recession?

During a recession, it’s important to take steps to secure credit and protect your finances. Here are some key tips:

1. Check your credit report regularly and fix any errors.

2. Build up your emergency savings to cover unexpected expenses.

3. Pay bills on time to maintain a good credit score.

4. Avoid taking on too much debt or opening new credit cards.

5. Consider consolidating high-interest debt with a low-interest loan.

6. Look for ways to increase your income or cut expenses.

7. Talk to your creditors if you’re having trouble making payments.

8. Avoid payday loans or other high-interest loans.

By following these tips, you can help protect yourself from the negative effects of a recession and secure credit for future financial needs.

How to Manage Cash Flow During Recession?

During a recession, organizations face economic challenges that can impact cash flow. To mitigate this, it’s important to identify strategies, such as analyzing expenses, negotiating with suppliers, and securing financing. Prioritize critical expenses and streamline invoicing to reduce operational costs. Seek professional advice for expert guidance on cost-cutting strategies and alternative funding options. By taking these measures, organizations can improve their ability to weather a recession and emerge stronger.

How to Increase Sales and Revenue in Recession?

In a recession, businesses must boost sales and revenue. Tips include focusing on existing customers, improving marketing, offering new products and services, reducing costs, expanding reach, and keeping an eye on market trends.

How to Make Customers Purchase Non-Essential Products?

To sell non-essential products, businesses should create a strong desire in customers. Using storytelling, emphasizing benefits and features, offering exclusive deals and showing social proof can help increase sales.

Adapting to Thrive: Embracing Change in Your Small Business

Small businesses must continuously adapt to changes in their marketplace to remain successful in today’s fast-paced environment. Adapting to thrive means embracing change and having a strategy to adjust to new circumstances. It is essential to have a forward-thinking mindset and be willing to take calculated risks to remain competitive.

One way to adapt is by staying up-to-date with emerging technologies and trends in your industry. Customer feedback and market research should also be regularly sought to understand how to better serve customers. Small businesses must also be agile, nimble, and able to pivot quickly when necessary to take advantage of new opportunities.

Embracing change requires strong leadership, effective communication, and a willingness to invest in staff training to foster a culture of agility and innovation. With the right approach, small businesses can overcome challenges and thrive in an ever-changing business landscape.

Customer-Centric Small Business: Building Loyalty and Trust

Customer loyalty is essential for a small business. A customer-centric approach is the key. It means prioritizing their needs, creating an unforgettable experience. Provide excellent customer service, train employees to listen and respond to them. Offer personalized service catering to unique needs. A loyalty program is also useful in building customer loyalty by offering discounts or special offers for repeat customers. By putting customers at the heart of the business, small businesses can build strong relationships that will last.

Numbers Game: Mastering Finances for Your Small Business

Mastering finances is essential for any small business owner. One important aspect is understanding the numbers game – knowing your business’s financial data and metrics. Start by creating a budget and sticking to it, monitoring cash flow, and analyzing financial statements such as balance sheets and profit and loss reports.

Knowing your break-even point and pricing strategy is also crucial. Set prices that cover costs while remaining competitive in the market. Consider implementing a customer rewards program to increase sales and customer loyalty.

Maintaining accurate records, setting financial goals, and seeking professional advice from accountants or financial advisors can help grow your business and avoid potential financial pitfalls. It’s important to prioritize financial management and stay informed to ensure long-term success.

Launching Your Small Business: Making a Grand Entrance

Launching a small business can be an exciting but daunting task. Making a grand entrance is crucial as it will set the tone for your business. First, identify your target audience and establish a unique selling point that sets you apart from competitors. Utilize social media to promote your launch and organize events to create a buzz. Network with individuals who can assist in spreading the word about your business. Consider offering special promotions or discounts during the launch period to encourage potential customers to try your business. Be prepared for any issues that may arise during the launch and have a contingency plan in place. Finally, listen to feedback from customers and adjust accordingly. A successful launch can pave the way for a prosperous future for your small business.

Small Business in the Digital Age: Essential Online Strategies

Small businesses need a modern website, SEO tactics, social media and email marketing to stay competitive. They should also gather online reviews and ratings, and may benefit from e-commerce capabilities, even if they primarily work offline. These strategies can help small businesses to attract and retain customers, build credibility and business growth.

Small Business Branding: Crafting a Memorable Identity

A strong brand identity is crucial for promoting and growing a small business, creating customer loyalty, and building recognition and trust. To do this, small business owners should brainstorm a unique logo, select complementary brand colors and fonts, establish clear messaging, and create a memorable customer experience. By implementing these elements, they can create a lasting impression that will help customers recognize and remember their brand.

Legal Essentials for Small Businesses: Getting Started Right

Starting a small business can be both exciting and daunting. Setting up a legal foundation is crucial for protecting your business interests. First, determine your business structure (sole proprietorship, partnership, LLC, etc.) and register with the appropriate state agency. Obtain the necessary permits and licenses for your type of business and location. Additionally, protect your assets and limit personal liability by obtaining business insurance. It is essential to create contracts and agreements to ensure clear communication with customers, employees, and partners. To safeguard against legal liabilities and protect intellectual property, file for trademarks, copyrights, and patents. Finally, stay up to date with regulations and seek legal counsel when making significant business decisions. By laying a strong legal foundation, small businesses can thrive and grow.

Blueprint for Success: Crafting Your Small Business Plan

A small business plan is crucial for success. It outlines goals, objectives and steps for achieving them. Key elements include executive summary, market analysis, marketing strategy, financial plan and operations plan. Summarizing these factors will help secure funding, attract investors and customers and guide you towards success.